What are the benefits of Blockchain Technology in the Insurance Industry? With the advancement of technology, the entire industry is undergoing a significant transformation, and the insurance sector is no exception. One such technology that is revolutionizing traditional operational services is blockchain. Although blockchain has gained popularity in empowering cryptocurrencies, it has become a game-changer for the insurance industry.

Want to know how blockchain impacts the insurance industry and what it means for insurance service providers and holders? To help you, we will cover everything related to blockchain in the insurance industry in this blog.

What is Blockchain and How Does it Work?

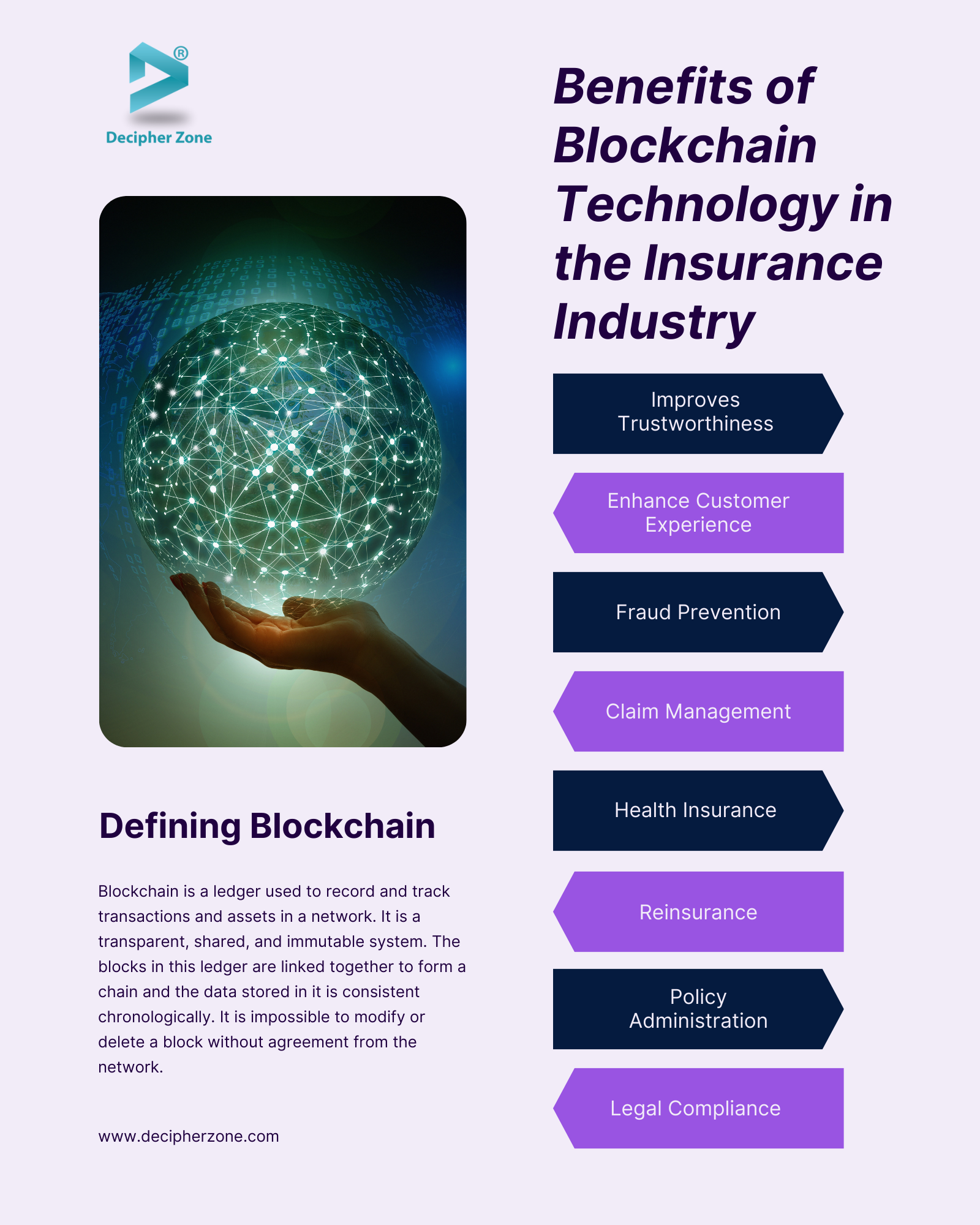

Blockchain is a ledger used to record and track transactions and assets in a network. It is a transparent, shared, and immutable system. The blocks in this ledger are linked together to form a chain and the data stored in it is consistent chronologically. It is impossible to modify or delete a block without agreement from the network.

When a transaction occurs, a block is created to record it in the blockchain. Whether it is a physical product or an abstract idea, the details in each block can include who was involved, what was exchanged, when it happened, where it happened, how much was exchanged, and even the product's condition.

The chain created by linking these blocks shows the asset's journey from one owner to another. This chain makes it easy to confirm the exact time and sequence of transactions and prevents any block from being tampered with or removed.

The verification of the previous block and the entire blockchain is strengthened as each block is added to the chain. This tamper-evident blockchain provides the key strength of immutability. It ensures the ledger of transactions is trustworthy and eliminates the possibility of tampering.

Top 8 Benefits of Blockchain Technology in the Insurance Industry

Some of the top 8 benefits that indulging blockchain in insurance can offer are as follows:

-

Improves Trustworthiness

-

Enhance Customer Experience

-

Fraud Prevention

-

Claim Management

-

Health Insurance

-

Reinsurance

-

Policy Administration

-

Legal Compliance

According to the Allied Market Research report, the blockchain in the insurance market will grow at a CAGR of 52.4% and reach a whopping $32.9 billion by 2031. So, it comes as no surprise that the use of blockchain in the insurance industry will grow exponentially in the upcoming years.

1. Improves Trustworthiness

Insurance companies can enhance their trustworthiness among stakeholders by implementing blockchain technology. The decentralized and immutable ledger of blockchain and the inclusion of consensus algorithms and smart contracts ensures transparency, audibility, and immutability, reducing the possibility of fraudulent activities while boosting trust in the network.

2. Enhance Customer Experience

With the help of smart contracts that automatically execute when predefined conditions are met, policy issuance, claim processing, and premium payments have become faster and seamless.

In short, insurance processes have become more accessible and streamlined, thanks to blockchain. As a result, blockchain has not only enhanced the overall customer experience but also made interactions with insurance providers more efficient and user-friendly.

Read More: What is Data Discovery: A Comprehensive Guide

3. Fraud Prevention

Several companies have suffered losses through fraudulent claims or cyber threats. However, the cryptographic algorithms and decentralization of blockchain can make insurance systems resistant to fraud.

As each transaction is recorded with time stamps in a secure and tamper-proof manner, the likelihood of fraud also decreases, facilitating better prevention mechanisms and easier fraud detection.

Read More: What is Cyber Resilience: Components, Benefits and Threats

4. Claim Management

Smart contracts utilize blockchain oracles to access external data relevant to claims swiftly. This allows for automated verification against policy terms. Additionally, the contracts contain encoded logic for prompt notifications of fraudulent claims and complex cases requiring manual intervention.

Both insurance teams and policyholders can easily track the progress of claim resolution thanks to the shared ledger. This minimizes disputes while reducing administrative costs, leading to improvement in the claim management processes.

5. Health Insurance

Blockchain in the health insurance industry can help with faster, more secure, encrypted, and more accurate data sharing among healthcare insurers and providers regarding the policyholder. This expedites the underwriting process while improving risk assessment accuracy.

Read More: Healthcare App Development Cost & Features

6. Reinsurance

Smart contracts are used to encode the pre-agreed terms of each reinsurance agreement. These contracts ensure that claims are validated directly based on a set of rules and that the loss coverage amounts for each party are calculated and executed automatically.

The blockchain network is utilized as a shared infrastructure for insurers and reinsurers to transact, track, and trace available business data. If parties are using their blockchain systems, cross-chain bridges can be utilized to allow for seamless interoperability between blockchains.

7. Policy Administration

Blockchain and smart contracts together can bring transparency in insurance policy creation, management, and issuance while automating terms and conditions, ensuring different involved parties are on the same page. This not only enhances policy accuracy but also reduces errors and dispute-related risks.

8. Legal Compliance

As all the transactions and contracts in blockchain are stored in a tamper-proof and secured manner, insurance companies can easily maintain compliance requirements with a clear record of legal standard adherence.

Smart contracts can also be set up to generate and submit insurance reports to regulators regularly while Proxy contracts can be used to adjust the rules of smart contracts in case of changes to legal requirements.

Conclusion

The insurance industry is undergoing a digital transformation as it explores and implements blockchain technology that improves trust, transparency, and efficiency. This revolutionary technology holds great promise for insurers and policyholders alike, as it delivers a highly secured data environment, introduces smart contracts, and streamlines the reinsurance process.

Overall, keeping up-to-date with these technological advancements will be essential for companies seeking a competitive edge in the rapidly changing insurance landscape.

And if you want to build blockchain-based insurance software, contact our experts now. Based on the details provided by you, they will share a personalized quote for the development along with other resource and technology requirements to make the process faster and more efficient.

FAQs: Benefits of Blockchain Technology in the Insurance Industry

What is blockchain?

Blockchain is a ledger used to record and track transactions and assets in a network. It is a transparent, shared, and immutable system.

What are the benefits of blockchain in insurance?

Some of the benefits that blockchain in the insurance industry provides are false claim rejection, enhanced trustworthiness, process automation, better customer experience, and efficient information exchange.

What are the use cases of blockchain in the insurance industry?

Blockchain in the insurance industry can be used for providing on-demand insurance, reinsurance, fraud prevention, microinsurance, auto insurance, life insurance, and health insurance.