Financial Software Development Features, Technologies, Cost in 2023. Regardless of the size of an organization they highly rely on technology for streamlining their processes.

Digitalization has made its way to several industries like manufacturing, hospitality, education, etc. and the finance industry is not much behind.

That being said, for bringing automation, streamlining, and optimization in various financial processes, finance software has become increasingly crucial.

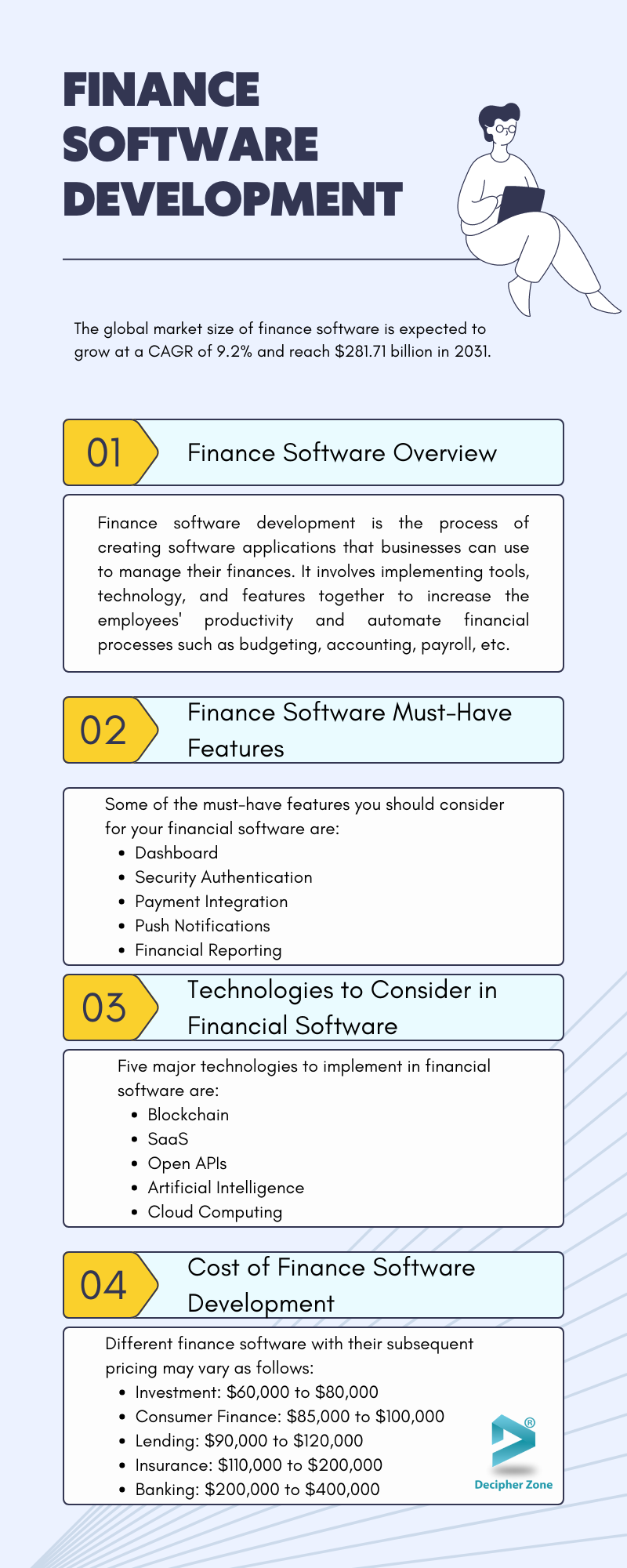

And if we take a look at the stats shared by Allied Market Research, the global market size of finance software is expected to grow at a CAGR of 9.2% and reach $281.71 billion in 2031.

But where can financial software help and what are the features that you should consider while opting for one? In this blog, we will dive into the financial software development world and share everything you need to know about.

Financial Software Development: An Overview

Finance software development is the process of creating software applications that businesses can use to manage their finances. It involves implementing tools, technology, and features together to increase the employees' productivity and automate financial processes such as budgeting, accounting, payroll, etc.

Read: Top 10 Latest Banking Trends

Aside from being used in some enterprise-level businesses for automating financial processes, FinTech or Financial software is majorly used by different finance sub-sectors like banking, investments, insurance, payments, loans lending, and virtual currency-driven platforms.

Some of the reasons why investing in custom financial software development can be lucrative for entrepreneurs are:

Automating:

The rise of globalization, mergers, diversification, and acquisitions in the corporate world has increased the complexity of accounting and financial processes, making it challenging to execute, coordinate, and track these processes. However, by investing in financial software solutions it becomes easier to automate, streamline, and consolidate critical financial activities and tasks while complying with the regulations.

Streamlining:

Most financial processes are broken into fragments and coherent, especially in enterprises with multiple sub-divisions, where each department may recognize income, budgeting, and revenue differently. This can lead to inefficiencies and process integrity issues. So, by using financial software, businesses can consistently create formal procedures across the organization on how financial transactions should be handled.

Accuracy:

Financial transactions and processes can reside on different databases scattered across different remote locations, making it difficult to monitor, manage, and gain complete visibility of an organization’s financial status. Thus, implementing financial software can help businesses in centralizing the database that can be accessed by end-users throughout the organization, creating a one-truth source that boosts data consistency and accuracy.

Adaptability:

Financial software solutions allow businesses to easily adapt to dynamic market trends, updates, and regulatory changes in real time.

Personalization:

Customers want businesses to understand their unique requirements and provide related solutions. So, developing financial software with user-behavior analytics can help you easily examine the data and create personalized services based on them.

Security:

Digitalization comes with the risk of cyber threats. And as a company’s database consists of personal information of the customer, bank account details, credit card information, or social security numbers, it becomes essential to incorporate high-end data protection. Fortunately, custom financial software comes with high-end data protection to help you avoid major cyber attacks.

Read: Decentralized Marketplace Development

Must-Have Features in Financial Software Development

Before hiring developers to create custom financial software for your business, you need to determine the features to integrate. While the list of features can vary depending on the business model, here are some of the must-have features you should consider for your financial software.

Read: Custom Accounting Software

-

Dashboard: Every data-driven app needs a monitoring and management system. A built-in dashboard can help with just that. A dashboard allows you to centralize all the transactional data, income, expenses, market updates, etc. in easy-to-understand, visualized format.

-

Security Authentication: For any financial web app, security authorization is necessary to have. You can integrate a multi-factor authentication method to minimize cyber threats and high data security.

-

Payments: In financial software, payment is one of the most common yet essential must-have features. Whether you have a lending business model or a B2B one, you need to make the payments secured, feasible, and real-time. You can either opt for bank-to-bank transfers, QR code payments, in-app wallet payments, etc.

-

Notification: To keep the end-users informed about investment offers, credit or debit updates, loan status, and more. Adding the push notifications feature in the finance software can help you in achieving that with ease.

-

Financial Reporting: With tons of data roaming freely in the database of the finance software, it is important to integrate reporting features that will help in in-depth analysis and provide useful insights to make more-informed decisions.

-

CRM Capabilities: To maintain a good relationship with your customers, you need customer relationship management tools in financial software.

-

Third-Party Integrations: Financial software should also have third-party integrations that help you integrate the required tools with the right API for adding different functionalities.

5 Technologies To Consider Implementing in Financial Software Development

To help you out we have enlisted five major technologies that you can consider implementing in the financial software development.

-

Blockchain

-

SaaS

-

Open APIs

-

Artificial Intelligence

-

Cloud Computing

With the plethora of technologies available in the market, Jelvix - financial software development services it can be quite confusing to choose the ideal ones for your financial software.

Read: The Future of Banking with the Growth of Technology

1. Blockchain

Blockchain is an immutable, distributed ledger that has immense potential in the finance system. It allows data to be recorded, shared, and synchronized across repositories in real time. With NFTs, Decentralized Finance, KYC, Distributed Ledger Technology, and Crypto Exchange, blockchain helps make the financial industry fast and immutable.

2. SaaS

Software-as-a-Service solutions are used to provide financial software as an online service that doesn’t require users to install the program in their devices to access the services while making it easier to maintain it. Using SaaS you don’t need to worry about the scalability and performance of the software at all.

3. Open APIs

Open API is the backbone of the Open Banking concept. It allows financial service providers to evaluate data from disparate sources and offer their customers personalized services with ease. With Open APIs, you can efficiently protect data via endpoints while providing an intuitive experience to the customers.

4. Artificial Intelligence

The power of AI can be seen in multiple data-driven industries. By learning and adapting from data, AI models can perform tasks without interventions from humans, making the workflow more efficient, accurate, faster, and error-free. In finance software, it can help in detecting frauds, responding to customer questions, and enhancing clients’ engagement.

5. Cloud Computing

Cloud computing liberates finance software from the bond of IT infrastructures and data centers by creating models such as open banking, banking-as-a-service, and more. It also helps in improving software security with features like data encryption and zero-trust verification. Not just that, but cloud computing also helps in reliability storing and maintaining data.

Cost of Financial Software Development

The cost of developing financial software can range anywhere from $60,000 to $400,000. However, without knowing the requirements of the financial businesses it can be difficult to give any definitive answer.

The finance software development cost depends on factors such as tech stack, app type, third-party integrations, features, etc. Typically, different finance software with their subsequent pricing may vary as follows:

-

Investment: $60,000 to $80,000

-

Consumer Finance: $85,000 to $100,000

-

Lending: $90,000 to $120,000

-

Insurance: $110,000 to $200,000

-

Banking: $200,000 to $400,000

How can Decipher Zone Help Financial Software Development?

If you want to hire experienced developers with vast knowledge and skills in developing finance software for a business, then we at Decipher Zone have what you need.

Our team of developers has years of knowledge and expertise under their belt. To leverage that expertise, all you gotta do is contact us and share your requirements.

After that our experts will get in touch with you for further discussion and give you an estimated cost depending on your unique business needs.