Quick Summary: Retail banking software development is transforming how banks and fintech startups operate and serve customers in the digital age. This comprehensive guide explains what retail banking software is, why it’s crucial in 2025 and beyond, and dives into its core features (from core banking systems and mobile apps to KYC/AML and API integrations).

What is Retail Banking Software?

Retail banking software (often synonymous with core banking software) is the enterprise software suite that banks use to manage consumer-facing financial products and day-to-day transactions.

In simple terms, it’s the digital backbone enabling retail banks to offer services like savings and checking accounts, loans, credit cards, and payment processing to the public.

This software encompasses everything from back-end systems that handle account management and transaction ledgers to front-end applications that customers use for online and mobile banking.

At its core, retail banking software must reliably record every customer transaction (deposits, withdrawals, transfers, payments) in real-time and in compliance with strict regulations. It provides the infrastructure to create, deploy, and manage financial products while storing sensitive customer data securely in line with local banking laws.

Modern retail banking platforms also power the user interfaces for ATMs, branch tellers, internet banking portals, and mobile banking apps – effectively the “face and feel” of a bank’s services in the digital realm.

By leveraging a robust retail banking software system, banks can ensure that every customer’s interaction (be it an ATM withdrawal or a mobile app funds transfer) is executed accurately, securely, and instantly.

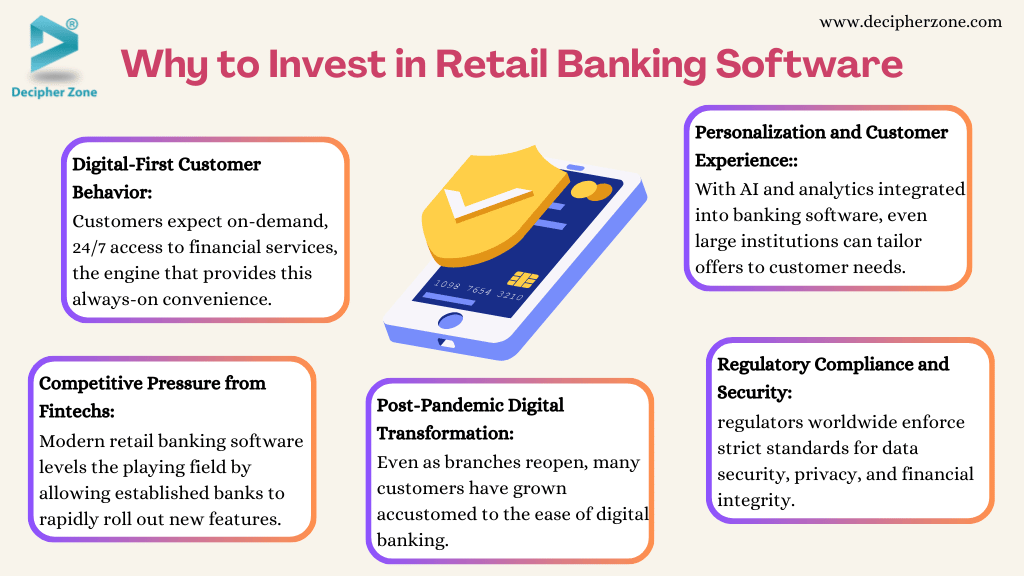

Top 5 Reasons to invest in Retail Banking Software Develpment

Here are 5 key reasons why investing in modern retail banking software is a top priority now and for the future:

-

Digital-First Customer Behavior

-

Competitive Pressure from Fintechs and Neobanks

-

Post-Pandemic Digital Transformation

-

Regulatory Compliance and Security

-

Personalization and Customer Experience

1. Digital-First Customer Behavior

Consumers increasingly prefer digital channels for banking. Globally, the number of digital banking users is projected to reach 3.6 billion by 2024, and by 2025 an estimated 90% of all banking interactions will occur through digital channels.

From mobile check deposits to online loan applications, customers expect on-demand, 24/7 access to financial services. Retail banking software is the engine that provides this always-on convenience. It enables banks to meet customers where they are – on their phones and laptops – with a unified, user-friendly experience.

2. Competitive Pressure from Fintechs and Neobanks

Agile fintech companies and digital-only “neobanks” are quick to deploy innovative financial products and personalized user experiences. Traditional banks, often burdened by legacy core systems, face a challenge to keep up.

Modern retail banking software levels the playing field by allowing established banks to rapidly roll out new features (like peer-to-peer payments or buy-now-pay-later options) and integrate with fintech services.

In fact, 82% of traditional banks plan to increase partnerships with fintech companies in the next three to five years, reflecting a strategy to enhance offerings via technology. A flexible software architecture (with open APIs and modular services) is essential to enable such collaborations and embedded finance models.

3. Post-Pandemic Digital Transformation

The COVID-19 pandemic accelerated digital adoption in banking. Even as branches reopen, many customers have grown accustomed to the ease of digital banking. Banks are consolidating physical locations (over 1,600 U.S. bank branches close per year on average as digital alternatives grow) and doubling down on technology.

Cloud-based core systems, contactless payments, and remote customer onboarding (e.g., video KYC) have moved from “nice-to-have” to “must-have” in 2025. Retail banking software is the cornerstone of this digital transformation – enabling banks to be resilient in crises and responsive to customer needs from anywhere.

4. Regulatory Compliance and Security

As banking goes digital, regulators worldwide enforce strict standards for data security, privacy, and financial integrity. Modern retail banking platforms come with built-in compliance management (for KYC, AML, data protection, etc.) that help banks avoid costly penalties. (Notably, global penalties for AML/KYC compliance failures surged 57% in 2023, reaching into the billions.)

Advanced software solutions matter because they automate compliance checks, flag suspicious activities, and generate audit trails – essential defenses in an era of rising cyber threats and stringent oversight. In 2025 and beyond, a bank’s software is effectively its first line of defense in protecting customer data and maintaining trust.

5. Personalization and Customer Experience

Banks are realizing that technology is key to delivering personalized, people-first service at scale. With AI and analytics integrated into banking software, even large institutions can tailor recommendations and offers to individual customer needs.

Nearly 79% of banks agree that customers want human-like AI interactions in digital banking. This means features like intelligent chatbots, virtual financial advisors, and predictive financial insights are becoming standard.

Modern retail banking software enables these advanced capabilities – using data to provide the kind of proactive, customized service that builds loyalty.

Read: Technologies Shaping The Future of Fintech

Top 7 Core Features and Modules of Retail Banking Software

As we’ll explore, the right features and technologies can turn a traditional bank into a digital leader – and help a fintech startup turn a disruptive idea into a reliable service.

Here are the key components:

-

Core Banking System

-

Mobile and Online Banking Applications

-

Customer Onboarding & KYC/AML Compliance

-

API Integrations and Open Banking

-

Customer Portal & Self-Service

-

CRM Integration (Customer Relationship Management)

-

Compliance and Risk Management

1. Core Banking System

The core banking system ensures that when a customer makes a transaction (like a fund transfer or loan payment), it is recorded in real-time, updating all relevant balances across the bank.

Modern core systems support multi-currency transactions, real-time gross settlement, and end-of-day batch processing for reconciliation. They are designed for high availability and accuracy, serving as the single source of truth for all customer financial data.

2. Mobile and Online Banking Applications

These are the customer-facing portals (mobile apps and web banking sites) that allow users to interact with the bank digitally. Through these apps, customers can check balances, transfer money, pay bills, deposit checks via photo, apply for new accounts or loans, and even chat with support.

A good retail banking platform provides a consistent, intuitive UI/UX across mobile and web channels. Features like push notifications for transaction alerts, biometric login (fingerprint/face ID), and personalized dashboards are common.

3. Customer Onboarding & KYC/AML Compliance

A crucial module that manages the process of enrolling new customers and verifying their identity. KYC (Know Your Customer) and AML (Anti-Money Laundering) features allow the software to collect customer information, verify IDs (e.g., via document upload or biometric checks), and screen for fraud or sanctions lists automatically.

This module often integrates with government or third-party databases to validate identities and ensure the bank complies with regulations. Strong KYC/AML tools not only keep the bank compliant but also help prevent fraud and financial crime at the source.

4. API Integrations and Open Banking

Modern banking software exposes APIs that allow secure integration with external services and fintech apps. API integrations enable Banking-as-a-Service models – for example, allowing third-party fintech apps to offer the bank’s services (like payments or account info) within their own platform (with customer consent).

This module manages API gateways, authentication, and data exchange protocols. It’s how a retail bank software can connect to payment networks (Visa, MasterCard), fintech products (budgeting apps, payment wallets), credit bureaus, and more.

5. Customer Portal & Self-Service

Beyond just transactional banking, retail banking software often includes a full customer portal where users can manage their relationship with the bank. This might include support ticketing, product dashboards (for loans, investments), document uploads/downloads (like statements), and communication preferences.

Essentially, it’s a one-stop hub for customers to update their profile, request services, track application status (e.g., a loan application), and get help.

Read: Ultimate Guide for Crypto Payment Gateway

6. CRM Integration (Customer Relationship Management)

To provide personalized service, banks integrate CRM capabilities into their software. A CRM module tracks customer interactions across channels, stores profiles and preferences, and helps banks analyze customer behavior.

Bank staff (like call center or relationship managers) use CRM data to see a customer’s history at a glance – such as products owned, recent inquiries, or complaints. For example, if the CRM shows a customer’s certificate of deposit is maturing, the system might prompt an offer for reinvestment.

In retail banking software, CRM integration ensures every customer touchpoint is informed by context and past interaction, boosting satisfaction and sales opportunities.

7. Compliance and Risk Management

In addition to KYC/AML, there are broader compliance management features. These include tools for regulatory reporting (to central banks or regulators), internal audit trails, risk scoring, and policy enforcement.

For instance, the software can generate reports required by regulators (like suspicious activity reports, or BASEL III capital adequacy calculations) at the push of a button. It can enforce credit risk limits (blocking a loan that would exceed a certain risk threshold) or ensure data retention policies are followed.

Given the heavy regulation in banking, this module is vital. It helps a bank stay compliant and avoid operational risks. In modern systems, many compliance checks are built-in and automated – reducing manual work and the chance of human error that could lead to fines or breaches.

Benefits of Modern Banking Software for Banks and Fintech Startups

We’ll look at how leveraging these features benefits banks and fintech startups alike.

Top 5 Benefits of Retail Banking Software for Banks

-

Operational Efficiency and Cost Savings

-

Faster Innovation and Product Launches

-

Enhanced Customer Experience and Retention

-

Improved Compliance and Risk Management

-

Scalability and Future-Proofing

1. Operational Efficiency and Cost Savings

Automating banking processes through software significantly reduces manual work, errors, and processing time. Routine transactions that once required paperwork and branch visits are now handled instantly online.

This shift translates into lower operating costs – banks running on modern core systems have seen their operating costs drop to a fraction. Fewer physical branches are needed when digital channels handle most volume, allowing banks to reallocate resources.

Overall, a robust banking platform streamlines everything from account opening to loan underwriting, leading to faster service delivery at lower cost.

2. Faster Innovation and Product Launches

A flexible software architecture (especially one based on microservices and open APIs) lets banks develop and deploy new products or features rapidly. Instead of months of coding on a monolithic legacy system, banks can use modular services to roll out offerings like a new mobile payment feature or an integration with a fintech partner in weeks.

This agility is crucial for staying competitive. For example, if a fintech trend like “buy now, pay later” emerges, a bank with modern software can quickly plug that into its app. Up-to-date retail banking software removes those roadblocks, enabling banks to innovate continuously and adopt new business models (like offering white-label banking services to other brands).

3. Enhanced Customer Experience and Retention

With a 360° digital platform, banks can provide a smooth and personalized customer journey. All channels (ATM, branch, web, mobile) are connected, so a customer could start a loan application online and finish it in a branch without restarting the process.

Personalization engines can analyze customer data to offer tailored financial advice or promotions (for instance, pre-approving a mortgage for a long-time savings customer). Higher customer satisfaction naturally follows when services are convenient and customized.

Studies show 76%+ of online banking users are satisfied with their digital experience, and satisfaction leads to loyalty. Modern software also means fewer outages or slowdowns, which boosts trust.

Essentially, a robust retail banking platform helps banks keep their customers happy and engaged, reducing churn in a competitive market.

4. Improved Compliance and Risk Management

As noted, advanced banking software automates compliance tasks and provides better oversight of operations. This greatly reduces the risk of regulatory breaches. For banks, avoiding fines (which can be massive in finance) and reputational damage is a huge benefit.

Compliance modules ensure every account and transaction is screened properly (e.g., flagging a suspicious transfer for review automatically). Risk management tools within the software can also monitor credit risk in the loan portfolio in real-time, or liquidity risk, and alert management to issues early.

By having these safeguards built into daily operations, banks maintain stability and can reassure regulators and customers that they are operating safely. In short, modern platforms not only speed up innovation but also tighten security and oversight, which is vital for long-term sustainability.

5. Scalability and Future-Proofing

Banks often deal with millions of customers and transactions. Today’s software solutions leverage cloud infrastructure and scalable architectures to handle growth effortlessly. If a bank’s user base doubles, a cloud-native core can scale up without a hitch (whereas older systems might buckle under increased load).

This scalability is crucial as digital adoption surges. Furthermore, by using updatable software components, banks can easily adopt future technologies – whether that’s integrating central bank digital currencies (CBDCs) or new payment rails.

A modern retail banking system ensures a bank isn’t locked into old tech; it can evolve with industry trends (for example, incorporating blockchain for certain processes or adding AI-driven tools). In essence, it’s an investment that “future-proofs” the bank, providing a technological foundation that can last decades with continuous improvements.

Read: Fintech App Development

Top Benefits of Retail Banking Software for Fintech Startups

-

Rapid Market Entry with Banking-as-a-Service

-

Innovation and Differentiation

-

Regulatory Compliance Out of the Box

-

Scalability and Growth Potential

1. Rapid Market Entry with Banking-as-a-Service

Fintech startups often have great ideas for financial services but need the underlying banking infrastructure. Retail banking software – especially offered as a service or via APIs – allows fintechs to launch new products without building everything from scratch.

For instance, a fintech e-wallet can integrate with a BaaS platform that provides core banking functions (account ledger, compliance checks), enabling the fintech to offer customers bank-like services under its own brand.

This drastically lowers the barrier to entry. A startup can focus on its unique user experience or niche service, while the proven banking software handles the heavy lifting of regulatory compliance, transaction processing, and security. The result is faster time-to-market and the ability to scale on a reliable backend.

2. Innovation and Differentiation

By leveraging modern banking software components, fintechs can mix-and-match services to create innovative offerings. Want to combine a budgeting app with a debit card and a crypto wallet? APIs and modular banking services make it possible.

Fintechs benefit from the flexibility of microservices architectures that many banking platforms now use – they can use only the features they need and customize the rest. This means startups can differentiate themselves with niche features (like an AI-powered financial coach or a unique rewards system) on top of a solid core.

Moreover, having access to real banking data (via integration) allows fintechs to harness insights and machine learning to refine their products. In short, modern banking platforms act as innovation sandboxes for fintechs to build the “next big thing” in finance with far less friction.

3. Regulatory Compliance Out of the Box

One of the hardest parts for a new fintech offering financial services is dealing with regulation and trust. Using an established retail banking software (often in partnership with a licensed bank) gives fintech startups a compliance-ready framework.

The software comes pre-packaged with KYC workflows, fraud detection algorithms, and reporting functions that meet regulatory standards. For a startup, this is invaluable – it ensures they don’t inadvertently run afoul of laws and it builds trust with users (who might otherwise worry about the safety of their money with a new player).

Essentially, fintechs can piggyback on the compliance rigor and security certifications of the platform provider, which is especially useful when scaling up or entering new markets with strict banking regulations.

4. Scalability and Growth Potential

If a fintech’s user base goes from 5,000 beta users to 5 million users, a well-architected banking backend can accommodate that surge with minimal performance impact. This scalability ensures the startup’s app remains fast and reliable even as it gains popularity.

Additionally, global reach is facilitated – many banking platforms have multi-currency and multi-country support, so a fintech can expand services internationally by simply toggling on new modules or integrations (subject to partnerships and licenses).

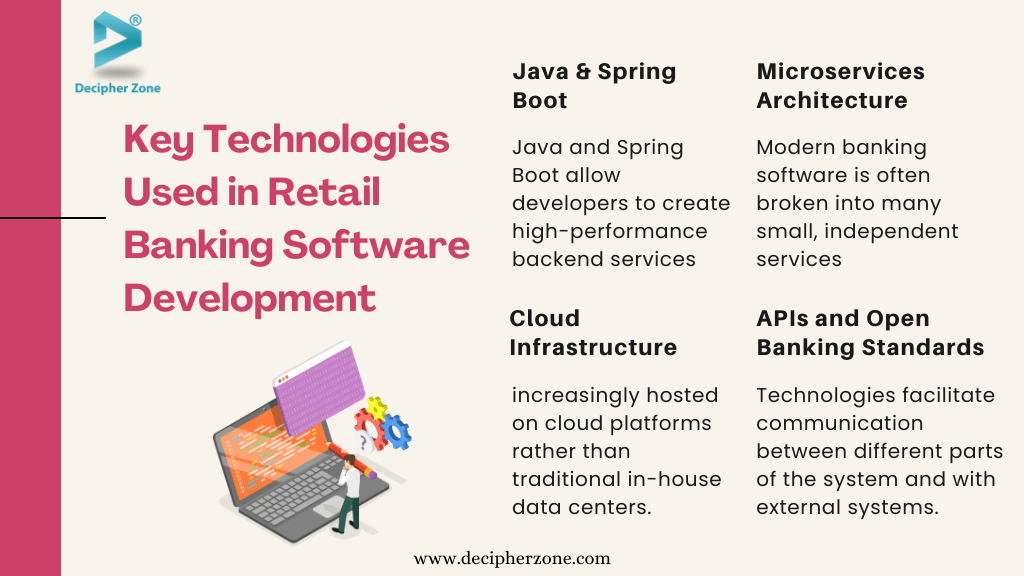

Top 7 Key Technologies to Use in Retail Banking Software Development

Here are some of the key technologies and paradigms commonly used:

-

Java & Spring Boot

-

Microservices Architecture

-

Cloud Infrastructure

-

APIs and Open Banking Standards

-

Blockchain

-

DevOps and CI/CD

-

Security Technologies

Developing a robust retail banking platform requires choosing the right technologies and architectural approaches. Decipher Zone and other industry leaders utilize a stack of proven tools and frameworks to ensure banking software is secure, scalable, and maintainable.

1. Java & Spring Boot

Java remains a cornerstone of banking software development due to its reliability, performance, and strong security features. Many core banking systems are built in Java, leveraging its vast ecosystem of libraries and enterprise tools.

Spring Boot (a module of the Spring framework) further accelerates development by providing ready-made configurations for microservices, web services, and database access.

Together, Java and Spring Boot allow developers to create high-performance backend services that handle complex banking logic (like transaction processing or interest computations) with ease.

These technologies are also known for excellent backward compatibility – crucial for banking systems that need to run for years and integrate with older systems.

2. Microservices Architecture

Instead of one giant application, modern banking software is often broken into many small, independent services known as microservices. Each microservice handles a specific function (e.g., a service for managing customer profiles, another for payments, another for loans).

This architecture offers significant advantages: it’s easier to scale parts of the system independently (if the payments service is getting heavy load, you can scale it up without affecting others), and it allows parallel development (different teams can build or update different services simultaneously).

Microservices communicate via APIs, making the whole system more modular and flexible. For a bank, this means new features can be added as separate services without overhauling the entire platform.

Technologies like Docker (for containerization) and Kubernetes (for orchestration) are often used to deploy and manage microservices in the cloud.

3. Cloud Infrastructure (AWS, Azure, etc.)

Retail banking software is increasingly hosted on cloud platforms rather than traditional in-house data centers. Cloud providers like Amazon Web Services and Microsoft Azure offer robust infrastructure-as-a-service, with global data centers, high availability, and compliance certifications.

By using cloud services, banks and fintechs gain on-demand scalability and pay-as-you-go cost efficiency. For example, a spike in transaction volume (say on Black Friday or during a stock market boom) can be handled by auto-scaling resources in the cloud.

Cloud platforms also provide built-in security features (encryption, network firewalls) and managed services for databases, analytics, and more. Many modern banking solutions use a hybrid cloud approach – critical data may reside on a private cloud or secure on-premise server, while front-end and less sensitive services run on public cloud – to balance security and convenience. Overall, cloud technology enables the agility and resilience that 24/7 banking demands.

4. APIs and Open Banking Standards

As mentioned, APIs are vital. Technologies like RESTful web services, GraphQL, and message queues (e.g., Kafka) facilitate communication between different parts of the system and with external systems.

In the banking domain, there are also specific standards – for instance, the OpenAPI specification for documenting APIs, ISO 20022 for payment messaging, and various open banking API standards (like UK’s OBIE standards or Europe’s PSD2 directives) that ensure interoperability.

Tools and frameworks that implement these standards are key technologies. By adhering to standardized APIs, banking software can more easily plug into networks and third-party services.

For example, Decipher Zone’s projects have used Apache Kafka and REST APIs for real-time data streaming in a Banking-as-a-Service platform, ensuring that transactions propagate instantly across services. Mastery of API tech is crucial for enabling the connected, ecosystem-friendly banking experiences of today.

"Ready to transform your bank's digital future? Contact us today for a free consultation on retail banking software solutions!"

5. Blockchain

Blockchain is an emerging technology in banking, used selectively for its strengths in security and transparency. While not every retail banking system uses blockchain, many are exploring it for things like secure decentralized record-keeping, smart contracts, and digital identity verification.

For instance, a blockchain-based module could be used for interbank settlements or to create an immutable audit trail of transactions (helpful in fraud detection and compliance).

Blockchain’s decentralized nature means no single point of failure and tamper-evident records – attractive features for finance. Some banks are using private permissioned blockchains to improve processes like cross-border payments or trade finance, resulting in faster and cheaper transactions than legacy methods.

Additionally, blockchain can enable new services like digital asset custody or cryptocurrency integration within banking apps. In development, frameworks like Ethereum, Hyperledger Fabric, or Corda might be used to build these solutions.

While still a niche component of retail banking software, blockchain tech is poised to play a bigger role in the next generation of banking systems, especially as central bank digital currencies and tokenized assets become mainstream.

.avif)

6. DevOps and CI/CD

Building banking software isn’t just about the code – it’s also about how you deliver updates reliably. Technologies and practices under the DevOps umbrella (like Jenkins, GitLab CI, or Azure DevOps for continuous integration and deployment) are used to automate testing and deployment of banking applications.

Given the need for zero downtime updates and rigorous testing (since any bug can have serious financial implications), DevOps is key. Automated pipelines run suites of unit tests, integration tests, and security scans every time new code is pushed, ensuring that only high-quality code goes live.

Containerization (with Docker) and orchestration (Kubernetes) we mentioned also come into play here for smooth deployment. By embracing DevOps, banking software teams can release new features faster and with greater confidence – crucial in an era where being first to market with a feature can be a competitive edge.

7. Security Technologies

Underlying all of the above, there’s a heavy emphasis on security tech in banking software development. This includes using encryption libraries (for encrypting data at rest and in transit), implementing multi-factor authentication for user logins, integrating identity and access management tools like Keycloak (used in Decipher Zone’s Tag Biometrics project for secure authentication), and employing vulnerability scanners and intrusion detection systems.

Secure coding practices are enforced through tools that check for OWASP top 10 vulnerabilities. Additionally, databases used (such as PostgreSQL or MongoDB in various projects) are configured for high security with proper access controls.

In essence, every layer of the tech stack is chosen and configured with security in mind – from the programming language (Java’s strong type system helps prevent certain exploits) to frameworks (Spring’s built-in security features) to deployment (cloud security groups, etc.).

Read: Financial Software Development Cost

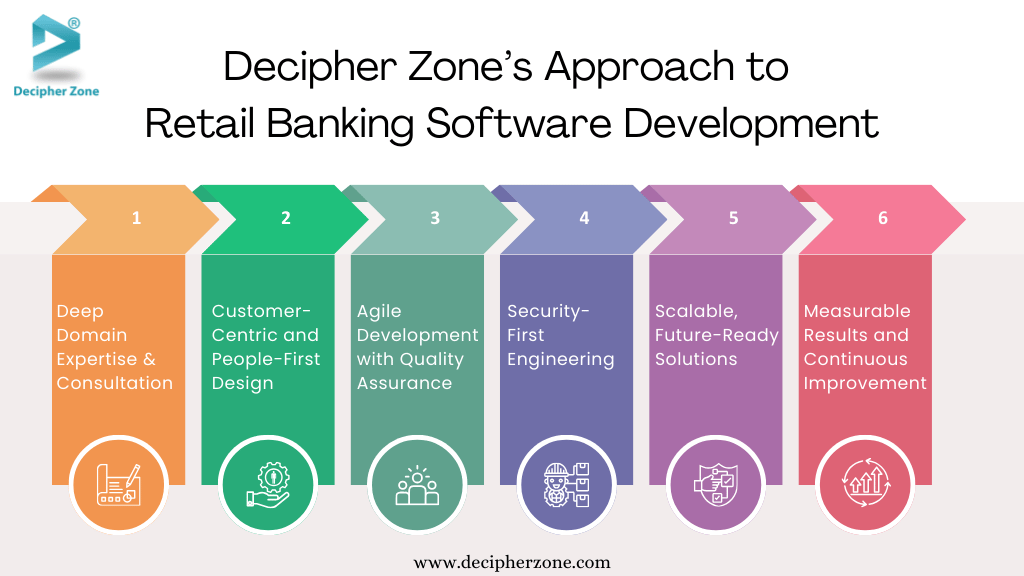

Decipher Zone’s Approach to Retail Banking Software Development

Here’s how we approach projects in this domain:

1. Deep Domain Expertise & Consultation

We begin by truly understanding the client’s needs – whether it’s a traditional bank modernizing its core system or a fintech startup building a new platform. Our team includes experts with experience in banking operations, compliance, and fintech innovation.

We speak the language of banking – from regulatory acronyms to industry best practices – so our development plans are rooted in real-world banking knowledge.

This upfront collaboration helps in crafting software that not only meets specs but also delivers genuine business value (like improved customer acquisition or faster loan processing).

2. Customer-Centric and People-First Design

We recognize that software, especially in retail banking, ultimately serves people – bank staff and customers. Our approach emphasizes intuitive UI/UX design and smooth customer journeys.

By adopting a people-first mindset, we ensure the software is easy to use and addresses pain points. For example, in one project we integrated an AI-driven chatbot to help guide users through onboarding, reducing drop-offs.

In another, we implemented real-time notifications and personal finance dashboards based on user feedback craving more insight into spending. By keeping end-users at the center, Decipher Zone builds banking applications that delight customers – which in turn drives higher adoption and satisfaction for our clients.

3. Agile Development with Quality Assurance

Banking requirements can evolve with market changes or feedback, so our development process is agile and iterative. We break the project into sprints, delivering incremental features for review. This agile approach allows flexibility to adapt to new insights or regulatory changes quickly. Throughout development, we have rigorous quality assurance.

Every build goes through extensive testing – functional tests, integration tests, performance benchmarking, and security audits. We use automated test suites and also conduct manual testing for critical user flows (like funds transfer or loan approval) to simulate real-world usage.

Our commitment to quality includes catching issues early and ensuring that by launch time, the software is stable and reliable. Given the high stakes in banking (where a glitch can affect transactions or security), we often invite client stakeholders to participate in User Acceptance Testing (UAT) cycles, so they have full confidence in the product.

4. Security-First Engineering

Trust is the currency of banking, and we embed security at every layer of our development approach. Decipher Zone follows secure coding standards and leverages robust security frameworks. For instance, when we built a card management system for Tag Biometrics, we implemented unique encryption tokens for each card and integrated Keycloak for authentication to ensure only authorized access to sensitive functions.

Our approach includes regular code reviews focused on security, penetration testing of the application, and compliance checks (like OWASP guidelines). We also design for compliance – e.g., making sure the data architecture supports GDPR data privacy requirements or PCI-DSS standards for payment data.

By proactively addressing security and regulatory compliance in the architecture and code, we deliver software that clients and their customers can trust out of the gate.

5. Scalable, Future-Ready Solutions

We architect solutions with a long-term perspective. Banking systems may need to run for decades, so we choose scalable and maintainable architectures. Decipher Zone is a strong proponent of microservices and cloud deployment to ensure the solution can grow and integrate new technologies over time.

Our developers also document and build with clean code principles, so that future enhancements or handovers are smooth. We often provide training to the client’s IT teams or detailed documentation as part of project handoff – empowering clients to manage and extend the product. And our engagement doesn’t necessarily end at launch: we offer ongoing support and iterative improvements.

Essentially, we treat each project not just as one-off software delivery, but as the creation of a living platform that will evolve with the client’s business.

This future-ready mindset has helped our clients quickly adopt new modules (for example, adding a digital wallet feature a year after initial launch was seamless because we had already built the APIs and microservices to be extensible).

6. Measurable Results and Continuous Improvement

Our approach is also outcomes-driven. We define key performance indicators (KPIs) for success – be it system uptime, transaction processing speed, user growth, or customer satisfaction metrics – and architect to meet those. After deployment, we closely monitor the software’s performance in production.

"Want to explore our retail banking software in action? Book a free demo with our experts today!"

Using analytics and feedback loops, we identify areas for improvement or optimization. For instance, if we observe that users are taking many steps to complete a certain task in the app, we’ll revisit that workflow in an update to streamline it.

In one case, after launch, we gathered user feedback that led us to implement a one-click payment re-scheduling feature in a banking app, greatly improving convenience. This willingness to continuously refine and improve is a hallmark of Decipher Zone’s approach – we stand by our solutions and ensure they keep delivering value.

Read: P2P Payment App Development

Case Studies: Real-World Successes with Decipher Zone

Nothing demonstrates our capabilities better than the success of our clients. Decipher Zone has delivered multiple retail and fintech banking projects, empowering both banks and startups to achieve their goals.

Here we highlight a few notable case studies and projects:

Letshego – Microfinance & Digital Banking in Africa

Letshego is a prominent microfinance and banking institution operating across multiple African countries, focused on delivering inclusive finance (such as small loans, savings, and payments) to underserved communities.

Decipher Zone helped Letshego develop and enhance a digital banking platform to broaden their reach. The solution included a mobile wallet app, an agent banking portal, and core service integrations for things like loan processing and bill payments.

.avif)

The modernized platform has significantly improved financial accessibility across Africa for Letshego’s customers. People in remote areas can now open accounts and perform transactions via their phones without needing a physical bank branch. The use of cloud services (AWS, Azure) ensures high availability – critical as Letshego’s user base grew.

Kubernetes containerization allowed the platform to scale smoothly during peak usage (for instance, during monthly loan disbursement cycles). By embracing digital channels, Letshego has empowered thousands of individuals and small businesses with reliable banking services, aligning with their mission of financial inclusion.

For Decipher Zone, this project demonstrated our expertise in multi-country deployments and building fintech solutions that work in low-bandwidth environments (important for some rural African regions where connectivity is limited).

BLAZE – ERP & Point-of-Sale System for Cannabis Financial Services

BLAZE is a specialized financial software suite designed for the cannabis dispensary industry, offering point-of-sale (POS), inventory management, and compliance tracking. While not a traditional bank, cannabis retailers face unique financial and regulatory challenges, and Decipher Zone contributed to a fintech solution to serve this niche.

We helped develop a part of the BLAZE system – particularly the app for dispensary staff and the backend integrations for payments and compliance.

React.js for the mobile POS application, and a backend stack including Java 8, Dropwizard (a Java framework), MongoDB for certain data stores, and integration with third-party services like Stripe and Twilio (for payments and SMS notifications respectively).

Data encryption was implemented (all data at rest is encrypted), and features like digital signature capture were added to eliminate paper forms.

The BLAZE platform we helped build allows cannabis dispensaries to manage customer check-ins, sales transactions, and delivery orders in a highly efficient manner.

Budtenders (dispensary sales reps) can sign up members, verify age and identity, and complete sales with an intuitive tablet app – significantly reducing wait times and manual paperwork.

One highlight is that new customers can sign all required agreements digitally on the iPad, and their information is stored securely (compliant with state laws). The system also automatically logs each sale with the required compliance data (metrc integrations for those familiar with cannabis compliance) ensuring the business remains in good standing with regulations.

By incorporating online payments and delivery management (like launching a customer’s address in a maps app for drivers), BLAZE has modernized an industry that traditionally dealt heavily in cash and manual logs.

For Decipher Zone, this case study demonstrates our flexibility – applying our banking software expertise (secure transactions, user management, etc.) in an adjacent domain to solve a real business need. The result was improved productivity for the client and a secure, user-friendly experience in an emerging fintech sector.

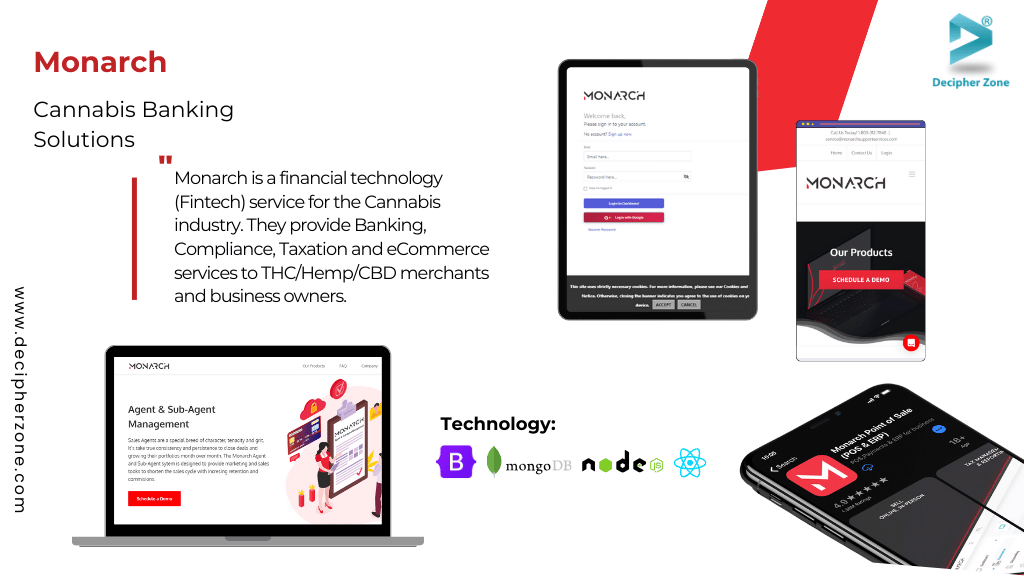

Monarch – Cannabis Banking & Digital Payments Solution

Monarch is an innovative platform bridging retail banking and the cannabis industry. In the US, cannabis businesses often struggle with banking due to regulatory complexities.

Monarch addresses this by providing a compliant digital banking solution – including digital wallets, payment processing, and tax compliance – tailored for cannabis businesses and consumers. Decipher Zone had the opportunity to contribute to aspects of Monarch’s development, focusing on its secure transaction engine and integration points.

The platform acts as a licensed money transmitter, so it heavily uses secure APIs and follows strict KYC/AML procedures for every user onboarding (integrating with identity verification services).

The user-facing side includes a mobile-friendly wallet app for end customers to manage funds and a web portal for merchants to send/receive payments and monitor their accounts.

Monarch has become a game-changer by moving money in a high-regulation environment with confidence and ease. It provides cannabis dispensaries and related businesses with access to banking functions that were otherwise difficult to obtain.

Through Monarch, businesses can send and receive digital payments (reducing reliance on all-cash operations), pay vendors, and even handle jurisdictional tax payments effortlessly (the system calculates and facilitates the required tax remittances for each locale, which is a huge pain point for these businesses).

For consumers, Monarch offers a digital wallet to make purchases at participating merchants or online, similar to how one would use any fintech payment app. The compliance-first design (Monarch ensures every transaction is tracked and reports are available for regulators) means both businesses and regulators have greater peace of mind.

This case demonstrates Decipher Zone’s strength in building trustworthy financial solutions: we helped Monarch blend conventional fintech with novel requirements, resulting in a platform that opens up financial services in a previously underserved sector.

The project’s success is evident as Monarch scales to more states and use cases, underlining our ability to deliver secure, compliant software in record time.

Why Choose Decipher Zone for Retail Banking Software Development

Selecting the right development partner is crucial when embarking on a banking software project. Here’s why Decipher Zone stands out as the ideal choice for banks and fintech startups looking to build or upgrade their retail banking software:

Proven Experience and Track Record

We bring over a decade of experience in custom software development, with a significant focus on financial services. Our portfolio and case studies (like those above) demonstrate that we have successfully delivered core banking systems, digital platforms, and fintech applications for clients around the world.

This breadth of experience means we’ve encountered and overcome many of the challenges that can arise in banking projects – from complex integrations with legacy systems to stringent compliance testing. When you choose Decipher Zone, you get a partner who has “been there, done that,” and can navigate the process efficiently.

Domain Expertise in Banking and Fintech

Writing code is one thing; understanding the nuances of banking is another. Decipher Zone offers both. Our team includes subject-matter experts familiar with banking operations, regulations like PSD2, SEPA, or RBI guidelines (for different regions), and fintech innovations. T

his expertise allows us to consult beyond just tech – we can advise on best practices for user onboarding flows to maximize conversion, or on how to structure data to simplify audits and reporting.

We stay updated on the latest in fintech (e.g., digital lending trends, neobank models, blockchain in finance) so that our solutions aren’t just technically sound, but also strategically aligned with where the industry is headed.

.avif)

Tailor-Made Solutions (No One-Size-Fits-All)

We understand that each bank or fintech has unique requirements, competitive differentiators, and regulatory environments. Decipher Zone specializes in custom software development, which means we tailor the solution to fit your needs perfectly rather than forcing an off-the-shelf product to work.

This bespoke approach covers everything from UI design that matches your brand and user demographics, to architecture choices that align with your IT strategy (be it cloud-first, on-premise, or hybrid).

The result is software that gives you a competitive edge – because it’s built specifically for you, it can do things or serve customers in ways that generic platforms can’t.

Moreover, custom doesn’t mean reinventing the wheel – we reuse proven components and frameworks (securely) where it makes sense to save time and cost, but always with customization where it counts.

Full Lifecycle Partnership

Decipher Zone offers support at every step of the journey. From initial consulting and requirements analysis, through development and rigorous testing, to deployment and post-launch maintenance – we’ve got you covered.

Our team can assist with cloud setup, data migration from legacy systems, user training, and even digital marketing advice for launching a new fintech product. Post-launch, we provide maintenance contracts to ensure your system stays updated and running smoothly.

We value long-term relationships: many of our clients return for phase 2 enhancements or new projects as their needs grow. This continuity means we accumulate deep knowledge about your business, which translates into even better service over time.

Quality, Security, and Compliance – Guaranteed

In banking software, there is zero tolerance for errors or security lapses. Our internal processes are geared to deliver top quality. We follow ISO-standard coding practices and every project undergoes thorough QA.

We also engage in third-party security audits and comply with OWASP and CERT guidelines for secure coding. For projects dealing with payments, we ensure PCI-DSS compliance. For personal data, we adhere to GDPR or relevant local privacy laws.

Our cloud deployments utilize best-in-class security (encryption, VPNs, etc.). In short, we treat your project with the same care as if we were building software for our own bank. The peace of mind that comes from our emphasis on security and compliance is a key reason clients choose and stick with us.

Read: Streamline Your Regulatory Compliance Easily

Competitive Pricing and Flexible Engagement

As a company with global presence, Decipher Zone offers cost-effective development rates without compromising quality. We work with startups and understand budget constraints, often phasing projects in a way that delivers core value first. For larger enterprises, we can provide dedicated development teams to work as an extension of your in-house team.

Our engagement models are flexible – fixed-price, time-and-material, or dedicated team – depending on what fits your situation best. We aim to provide maximum ROI for your investment in software development, and we’re happy to share references or testimonials from past clients to give you confidence in our value proposition.

FAQs

What is retail banking software development?

Retail banking software development is the process of creating digital systems that power the consumer-facing side of banking. It involves building the applications and back-end services that allow banks to manage customer accounts, process transactions, and provide online/mobile banking services. This can include developing core banking systems (for handling deposits, loans, payments, etc.), as well as customer-facing interfaces like banking websites and mobile apps.

Why choose custom banking software over an off-the-shelf solution?

Off-the-shelf banking software can be quicker to deploy, but it may not fit an organization’s specific needs. Custom retail banking software offers tailor-made functionality aligned exactly with your business model and customer experience goals.

With custom development, you have the flexibility to implement unique features that differentiate your services in the market (for example, a novel savings product or a custom rewards program integrated into your app).

You’re not constrained by the limitations of a generic platform. Additionally, custom solutions can be better optimized for your operational workflows and can integrate seamlessly with your existing systems.

While off-the-shelf solutions might come with bloat (features you don’t need) or lack something critical for you, a custom build gives you control over the feature set.

How do we ensure security and compliance in banking software?

Security and compliance are paramount in any banking software project. To ensure security, we employ multiple layers of protection: secure coding practices, code reviews, and penetration testing are standard.

Data is encrypted both in transit (using protocols like HTTPS/TLS for all communications) and at rest (using database encryption or disk encryption), so sensitive information is protected.

We also implement robust authentication and authorization mechanisms (for instance, multi-factor authentication for users, role-based access control for internal systems, etc.). Regular security audits are conducted, sometimes with external cybersecurity firms, to test for vulnerabilities.

How can fintech startups leverage retail banking software to launch new services?

Fintech startups can leverage retail banking software in a few ways to accelerate their launch. One common approach is using Banking-as-a-Service (BaaS) platforms or open APIs provided by banks.

Instead of building an entire banking stack from scratch, a fintech can integrate with a BaaS provider that offers modular banking services (for example, account creation, payments, card issuance) via APIs.

This allows the fintech to focus on its unique value proposition and user experience, while the underlying banking transactions and compliance are handled by the platform.

How long does it take to develop a retail banking software solution?

The timeline for developing a retail banking software solution can vary widely depending on the scope and complexity of the project. A simple banking mobile app that interfaces with existing bank systems might take a few months (say 4–6 months) to design, develop, test, and launch.

However, a full-scale core banking system or a comprehensive digital banking platform (which includes backend, user-friendly interface with advanced features, numerous third-party integrations, etc.) can take significantly longer – often 12 to 18 months for an initial launch, and that can extend further for very large banks doing phased rollouts.

Connect for Digital Banking Transformation

Decipher Zone is uniquely positioned to be your trustworthy technology partner in retail banking software development. We blend financial industry savvy with engineering excellence and a human-centric touch. By choosing us, you choose a team that will go the extra mile to understand your vision, mitigate your risks, and deliver a product that propels your business forward.

We are excited to collaborate with you, from brainstorming ideas to deploying a game-changing platform that will delight your customers and drive your business forward.

**Disclaimer: Some images used in this article have been generated with the assistance of AI from Meta AI.