Role of Blockchain in Fintech in 2023. Blockchain has evolved significantly and has way more to grow. But with its integration into different industries, it has given businesses a whole new meaning and has automated, optimized, and streamlined their processes.

Be it blockchain in gaming, the supply chain industry, or real estate, it has opened numerous possibilities for them to grow. And among all one such industry is the finance sector. And if you are curious about learning more about the role of blockchain in Fintech, then continue reading.

Role of Blockchain in The Fintech Industry in 2023

What is the role of Blockchain in FinTech industry in 2023? Blockchain in FinTech is the new buzzword in the Finance industry nowadays. It is the integration of blockchain technology in this specific industry that helps in enhancing their services and leveraging growth opportunities.

Fintech Blockchain has helped many businesses grow enormously, and according to the reports from Research and Market, the global FinTech Blockchain market is estimated to reach $43.1 billion by 2030, from $1.4 billion in the year 2022, at a CAGR of 53.6%.

In addition, integrating blockchain technology in the finance sector also helps in offering the firms a whole new level of security and freedom, alongside optimizing their operations and improving their workflow and productivity.

What are the Benefits of using Blockchain in Fintech?

Blockchain in Fintech plays an important role for businesses as well as their customers and lays a huge impact.

Some of the ways it helps are -

-

Improved Service

-

Cost-Effective

-

Huge Processing Power

-

Faster Transaction

-

Better Transparency

1. Improved Services

The integration of Blockchain in the FinTech sector helps in providing customized services that fit the specific needs of the users.

It helps businesses to track their performance and provide better services to their customers, which in turn also helps in increasing their customer base alongside customer retention, and also brings in more opportunities to conduct business effectively and efficiently.

2. Cost-Effective

One primary benefit of using blockchain technology in the FinTech industry is that it provides a cost-effective solution for businesses. Since blockchain technology eliminates the need for intermediaries, it can also be programmed to accept information from any source, thus helping to save costs for businesses.

Furthermore, smart contracts, also reduce operational costs, labor costs, and overhead charges which in turn also boost the profit margins for these businesses.

Read: Financial Software Development

3. Huge Processing Power

Blockchain technology is also known for its high volume of transactions and processing power. It is capable of managing and processing a high volume of transactions without slowing down, which makes it an important reason for FinTech businesses to choose Blockchain.

In addition, there are no intermediaries required to process the transactions, which is why, it makes the process fast and efficient.

4. Faster Transaction

Lightning-fast transactions are an important factor for FinTech businesses to ensure customer satisfaction and improved user experience. Since we all know that blockchain transactions are stored publicly, it does not require any third party to verify the transactions.

Therefore, it processes and validates the transactions immediately on and across all the nodes in the blockchain networks, making it quick and easy.

5. Better Transparency

Blockchain is already known for three key reasons i.e. transparency, decentralized nature, and smart contracts. One of the important reasons why FinTech companies are using blockchain is because it provides transparency in the network.

It helps in tracking down the transactions along with their origins with ease, without consuming much time.

Use Cases of Blockchain in the Fintech Industry in 2023

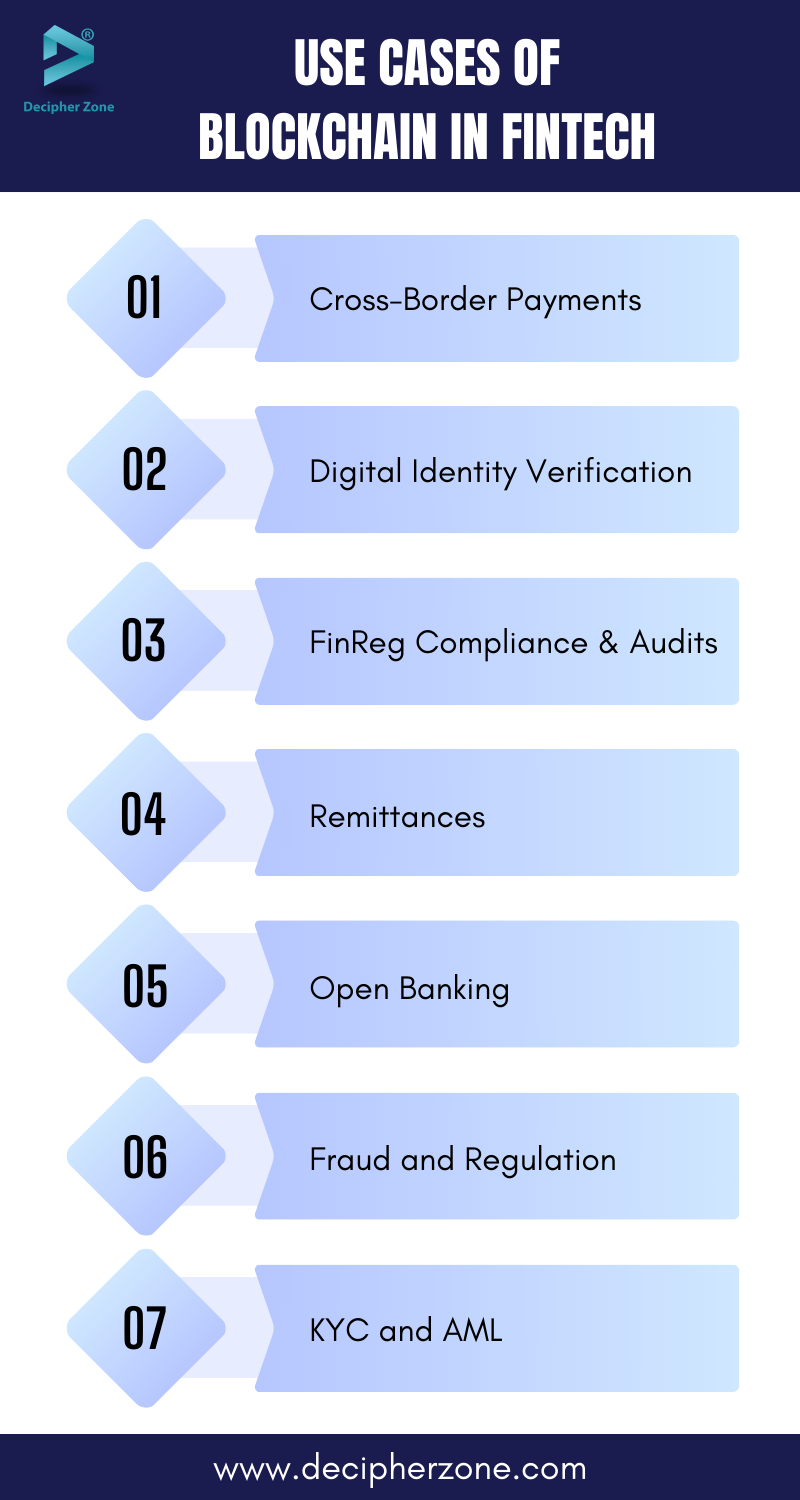

Blockchain for FinTech is a very powerful tool and has numerous use cases, some of them are as follows -

-

Cross-Border Payments

-

Digital Identity Verification

-

FinReg Compliance and Audits

-

Fraud and Regulation

1. Cross-Border Payments

Blockchain facilitates decentralized currency and cross-border payments which improve the flow of currency and makes the transactions flexible and effortless. It helps in making the payments fast and also decreases the amount charged in processing the transactions.

2. Digital Identity Verification

Security is an important aspect of online banking, but blockchain comes to the rescue here as well. It helps in creating and personalizing digital identity using avatars and other essential elements. It uses different methods and processes like KYC and AML to verify and validate a customer’s identity which also eliminates the risk of identity theft and other possible issues.

3. FinReg Compliance and Audits

Blockchain also helps in compliance with the financial rules and regulations, which in turn provides all the data that is required for analysis and auditing. It provides an efficient way to store the data, which also enables transparency and accuracy in maintaining the records.

Read: Consensus Algorithms in Blockchain

4. Fraud and Regulation

Blockchain’s secure nature is the primary reason why financial institutions use this technology in their business. It secures the data using cryptography, which is hard to decipher and helps in detecting fraud. Since FinTech companies are highly into making cross-border transactions it is important that using blockchain technology will ensure security and eliminate all the frauds and risks that might come along the way.

Read: Trends in Blockchain Technology

Wrapping It Up

Blockchain is revolutionizing businesses from every sector and has opened up new ways for them to grow. And when talking about Finance and technology, Blockchain in Fintech is disrupting the traditional methods to bring in a new approach to making the workflow fast alongside increased productivity.

So, if you are thinking about integrating blockchain technology into your business, hire a blockchain developer, or connect with us to help you develop the best solutions for your business and take it to new heights.

FAQs About Role of Blockchain in Fintech in 2023

What is Blockchain?

-

Blockchain is an open-source decentralized platform that has no intermediaries. It is transparent and helps in maintaining a digital ledger of all the transactions which cannot be altered, hacked, or destroyed.

What is FinTech?

-

Portmanteau of Finance and Technology, is the practice where finance companies and businesses use technology to improve their methods of financial services.

What are the examples of some of the FinTech startups?

-

Some examples of FinTech startups are Monarch, Bextra, Blaze, Credits, and Letshego.

What is the difference between PayTech and FinTech?

-

PayTech is a part of Fintech that focuses on Payments that involve technology whereas FinTech is itself a separate industry, that involves finance companies and businesses using technology.