Quick Summary: Big data analytics is here to empower and reshape the oil and gas industry through and through. While dealing with data isn’t new in this sector, analyzing it accurately and getting invaluable insights like never before is something to look forward to.

In this blog, we have covered everything from definition to key components, challenges, benefits, and tech stack about big data analytics in the oil and gas industry to help you grasp the details effectively.

Data has emerged as a key catalyst in decision-making processes across almost every industry, equipping businesses with invaluable insights to optimize their operational efficiency and overall performance.

A recent report from Globe Newswire highlights a remarkable trajectory for the big data analytics industry, predicting it will reach an astonishing $1.2 trillion by 2032, with a CAGR of 14.5%

While the concept of big data analytics may be relatively new to some industries, oil and gas companies have long dealt with extensive data volumes to make informed decisions.

In their relentless pursuit of understanding what lies beneath the Earth’s surface, these companies have historically invested in significant amounts of comprehensive visualization tools, advanced seismic tools, and various innovative technologies.

However, with today's vast ocean of available data, these organizations recognize the urgency to elevate their analytical capabilities and refine their strategies to remain competitive in the data-driven landscape.

Therefore, in this blog, we will take a closer look at big data analytics in the oil and gas industry, learning its necessity along with the ways to implement it for better processes and improved return on investment.

What is Big Data Analytics Software?

Big data analytics is the systematic process of extracting and analyzing large and complex datasets from diverse sources to gain valuable insights using advanced analytical tools and techniques. Big data analytics allows businesses to identify patterns, trends, and correlations in large raw data that helps analysts make data-driven decisions.

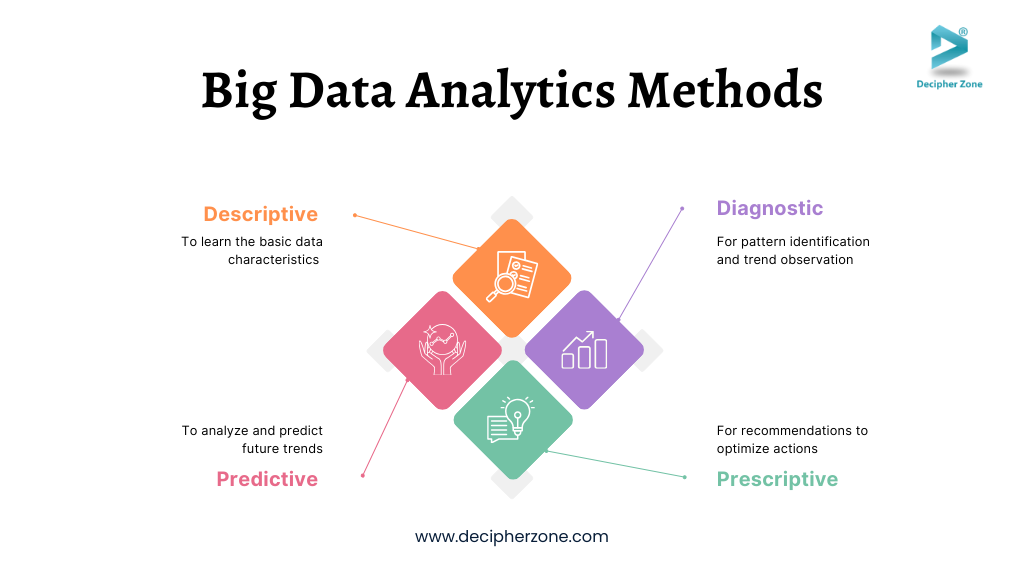

There are four major methods for analyzing big data; descriptive, diagnostic, predictive, and prescriptive.

-

Descriptive analytics focuses on summarizing and interpreting to learn the basic characteristics of data;

-

Diagnostic analysis deals with root pattern identification and trend observation;

-

Predictive analytics uses historical data, machine learning, and statistical modeling to predict future trends;

-

Prescriptive analytics provides recommendations to optimize actions based on driven insights from all previous stages.

Top 5 Key Components of Big Data Analytics Software in the Oil and Gas Industry

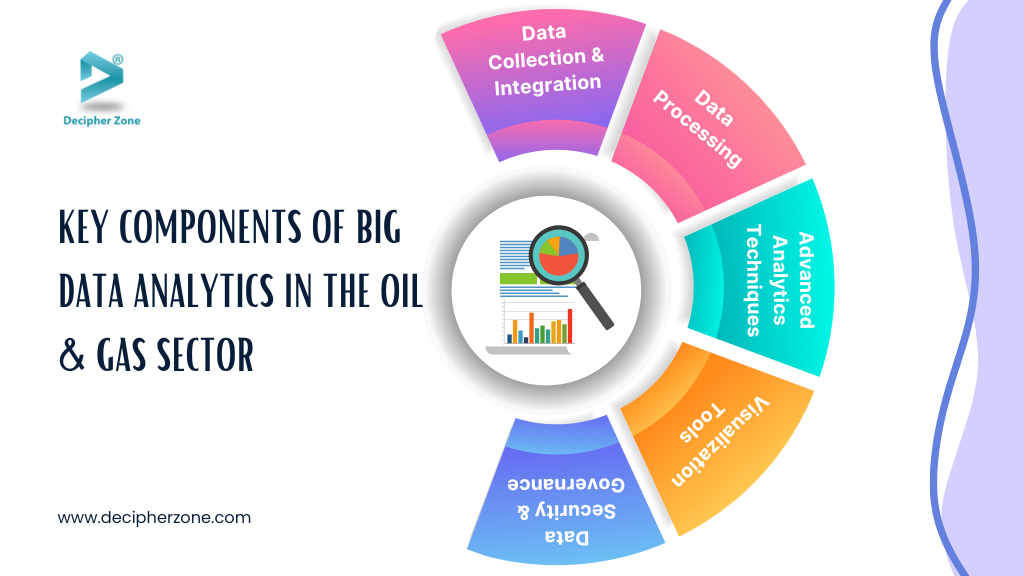

Big data analytics cannot operate in isolation; it involves several essential components that empower oil and gas companies to discover new growth opportunities.

Let’s check out the different elements that make up big data analytics powerful enough to transform the industries below.

-

Data Collection and Integration

-

Data Processing

-

Advanced Techniques for Analytics

-

Visualization Tools

-

Data Security and Governance

1. Data Collection and Integration

The first essential step towards data analytics in the oil and gas industry involves data collection, which can be in the form of unstructured or structured data collected from different sources like IoT sensors, seismic surveys, satellite imagery, mobile applications, and cloud services.

This is where businesses adapt strategies for data collection and integrate data from diverse sources into centralized repositories to automatically assign metadata for better accessibility and management. These centralized data repositories can be data warehouses, data lakes, and DBMS software.

2. Data Processing

Once the data is collected, it becomes a necessity to process it by organizing, extracting, transforming, and loading it into storage systems like MongoDB, NoSQL, Google Cloud Storage, Apache Cassandra, etc.

In data processing, raw data is converted into a usable format through data aggregating and type conversion. Tools like Apache Spark and Hadoop help in processing massive amounts of distributed datasets, improving efficiency and speed.

Strategies like stream processing and batch processing can help businesses process smaller volumes of data in real time and large volumes of data over extended periods respectively.

3. Advanced Techniques for Analytics

Implementing advanced analytical techniques like machine learning, deep learning, predictive analytics, and data mining algorithms is crucial to extracting insights from real-time and historical data.

These techniques enable businesses to identify patterns, forecast production outcomes, predict equipment failures, and more for informed decision-making.

4. Visualization Tools

Another essential element of big data analytics is visualization tools. These tools support businesses in transforming complex data into actionable insights through dashboards, reports, interactive operational data, etc. to gain a clear understanding of the current operational stage.

Apart from that, integrating 3D modeling tools in the oil and gas sector provides detailed visualization of reservoirs and drilling activities, enabling geoscientists and engineers to plan and carry out operations efficiently.

5. Data Security and Governance

In today’s world, ensuring data security is essential due to the rising threats posed by cyber-attacks. To safeguard sensitive information in software used by the oil and gas industry, encryption technologies and access control systems play a crucial role in preventing unauthorized access.

Besides, effective data quality management practices are vital for promoting data reliability, consistency, and accuracy, which in turn support informed decision-making and compliance with regulatory standards.

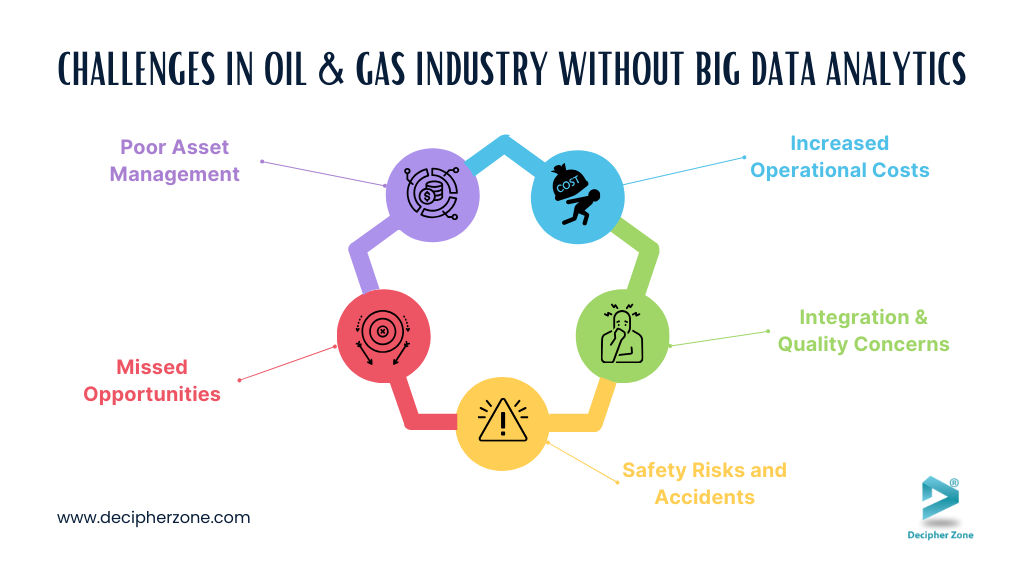

Top Challenges Faced by Oil and Gas Companies Without Big Data Analytics Software

The oil and gas industry operates in a highly competitive and complex environment, requiring precision and efficiency. Without big data and analytics, companies associated with this sector are more likely to face several challenges that hinder their performance and revenue.

Some of these challenges are:

-

Poor Asset Management

-

Missed Opportunities

-

Safety Risks and Accidents

-

Integration and Quality Concerns

1. Poor Asset Management

Oil and gas companies manage various types of infrastructure, including storage facilities, pipelines, and drilling rigs. Without real-time monitoring and predictive insights derived from big data analytics, these companies risk underutilizing their assets and experiencing degradation over time.

The lack of such analytics makes it challenging to identify which assets need maintenance and optimization, potentially leading to inefficiencies and increased operational costs.

2. Missed Opportunities

As the world moves towards sustainability, oil and gas companies need to innovate and adapt. However, without data analytics, finding renewable energy opportunities and improving operational efficiency to reduce carbon emissions become challenging, limiting the ability of companies to stay energy efficient and competitive.

3. Safety Risks and Accidents

Undoubtedly, the oil and gas industry operates in hazardous environments where safety is of utmost importance. Having no analytics can lead to no predictions of leaks, equipment failures, or malfunctions, therefore, increasing the risk for workers and operations simultaneously.

4. Integration and Quality Concerns

Tons of data get collected from various sources every day within the oil and gas industry which needs to be processed and integrated coherently. But, without investing in big data analytics, it can be challenging to maintain the quality and consistency of the data.

If the data is not handled meticulously, its poor quality and irrelevancy can distort analytical results, causing misguided strategies and decisions within the organization.

Increased Operational Costs: Identifying equipment efficiencies and processes can be difficult without data analytics. This can lead companies to unexpected downtimes, unplanned shutdowns, increased energy consumption, and costly repairs that will significantly increase the overall operational costs.

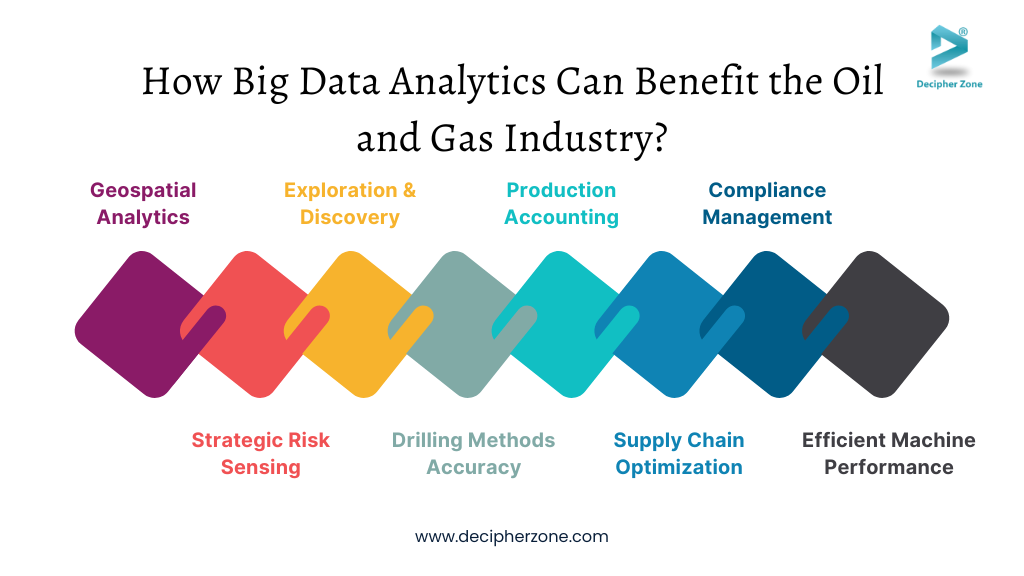

Top 8 Benefits of Big Data Analytics Software for Oil and Gas Industry

Integrating analytics to navigate the complexity bestowed on oil and gas companies by geophysics, shale geology, stimulations, and operations can offer several benefits, some of which are outlined below.

-

Geospatial Analytics & Visualization

-

Strategic Risk Sensing

-

Exploration & Discovery

-

Better Accuracy in Drilling Methods

-

Production Accounting

-

Supply Chain Optimization

-

Environmental and Regulatory Compliance

-

Efficient Machine Performance

1. Geospatial Analytics & Visualization

With the geospatial analytics and visualization features in the big data analytics software, evaluating pipeline risks by focusing on vulnerabilities and impact becomes easier. Vulnerabilities can encompass inspection frequency, historical incidents, and likelihood of encountering natural hazards.

On the other hand, impact relates to the potential consequences of a failed pipeline due to water supplies, heavy population areas, and ecologically sensitive spots. Overall, big data analytics helps organizations accurately gauge the risks associated with individual pipeline segments, which is vital for improving safety protocols.

2. Strategic Risk Sensing

Traditionally, unstructured data like satellite images, geographical surveys, and field notes used to be stored across databases making it difficult to retrieve or analyze. However, in the oil and gas industry, data science serves as a valuable tool as it provides methods to streamline the interpretation and management of data.

With data analytics, statistical models, and machine learning, these businesses can understand geological systems that reveal variations in rock layer composition and arrangement across regions to minimize risks. This analysis and insights lead to better resource management, decision-making, risk sensing, and environmental governance.

3. Exploration & Discovery

Seismic data is paramount in oil and gas exploration and discovery. Big data analytics assists in examining data and providing insights into the subsurface to improve energy source identification, strategic decision-making, effective gas exploration, and risk mitigation against temporal, financial, and environmental losses.

It analyzes historical production and drilling data to validate geologists' and geophysicists' hypotheses, integrates various geospatial reports and data in reservoir exploration, and enables data scientists to develop better scientific models to save costs, identify seismic trees, and analyze data visualization.

4. Better Accuracy in Drilling Methods

Once oil and gas sources are pinpointed, companies leverage advanced drilling techniques along with big data analytics to extract these resources more effectively. By providing real-time insights, big data analytics enhance asset performance, boost productivity, and reduce the chances of failures.

With real-time sensory feedback, these analytics optimize drilling parameters and identify anomalies, helping to avert incidents such as blowouts. They also highlight factors that contribute to non-productive time, enabling proactive solutions to issues.

The drilling sensors facilitate predictive modeling within big data software, empowering engineers to make quick, informed decisions and accurately estimate the time needed for drill maintenance.

5. Production Accounting

Data analytics is essential for boosting oil and gas production by predicting future trends and refining extraction techniques. By examining historical production data, it helps identify patterns that can lead to cost savings by highlighting inefficiencies and potential leaks.

For example, data analytics can be used to assess reservoir levels, locate geological formations during the drilling of oil wells, and accurately forecast production outputs.

It also improves the performance of electric submersible pumps (ESPs) by analyzing past data to foresee problems and prevent critical failures, such as overheating or unsuccessful start-ups. Overall, these applications empower production engineers to cut production costs and enhance operational efficiency significantly.

6. Supply Chain Optimization

Big data analytics provide valuable insights into the complex supply chain, making it another unparalleled benefit in the oil and gas industry. By examining the various streams of data generated throughout this supply chain—covering everything from inventory levels to logistics and procurement processes—companies can achieve a clear understanding of their operations.

This ability to analyze substantial amounts of information enables organizations to accurately forecast future demand and identify potential bottlenecks that could hinder progress. Apart from helping in risk management, it also helps in inventory level optimization.

As a result, companies can significantly improve the availability of oil and gas resources at fueling stations. What’s more? By utilizing big data to identify the most efficient transportation routes, companies can ensure a smooth flow of energy resources, benefiting consumers and enhancing operational efficiency.

7. Environmental and Regulatory Compliance

Implementing big data analytics in the oil and gas industry significantly enhances compliance with industry standards. By utilizing advanced analytics, companies can track and analyze sensor data from storage tanks and pipelines, enabling real-time monitoring of operational performance and environmental impact.

For instance, sensors can detect changes in pressure or flow rates, helping identify leaks early and minimizing the risk of spills. It also aids in monitoring carbon emissions from reservoirs, ensuring companies stay within regulatory limits and avoid penalties.

Big data analytics also facilitate compliance report generation that demonstrates a commitment to environmental preservation.

8. Efficient Machine Performance

Oil drilling is a relentless pursuit, requiring powerful machinery to work non-stop for long hours in tough and often extreme conditions. To protect these massive machines from potential breakdowns and failures, the power of big data plays a critical role.

Each piece of equipment is outfitted with advanced sensors that carefully collect performance data, tracking everything from temperature changes to mechanical stress.

This critical information is then analyzed against a vast pool of aggregated data, enabling precise decisions about when and how to replace parts. By doing so, efficiency is maximized, downtime is greatly reduced, and unnecessary costs are kept in check, ensuring smooth operations in one of the world’s most challenging environments.

Tpp Technologies to be Used for Big Data Analytics Software Development

When developing big data analytics software for the oil and gas industry, the tech stack we have listed below is used by the majority of the development companies.

|

Purpose |

Technology |

|

Raw Data Storage |

Amazon S3, Azure Data Lake, Hadoop HDFS, Google Cloud Storage, IBM Cloud Object Storage |

|

Stream Message Ingestion |

Apache Kafka, Azure Stream Analytics, Redis, Apache Goblin, Amazon Kinesis, IoT Hub |

|

Data Mining |

Presto, Rapidminer, Apache Mahout, Apache Spark, Teradata Warehouse Miner |

|

Stream Processing |

Apache Storm, Apache Spark, Apache Flink, Google Cloud Dataflow, Azure Stream Analytics, Confluent Cloud |

|

Batch Processing |

AWS Batch, Apache Hadoop, Azure Batch, IBM Workload Automation, Hive, Google Cloud Dataproc, Amazon EMR |

|

Analytics Data Storage |

MongoDB, Splunk, Amazon Redshift, Microsoft Fabric, Google BigQuery, Oracle Exadata, Snowflake |

|

AI/ML Programming Languages |

Java, Python, Scala, C++ |

|

Data Orchestration & Management |

Apache Airflow, AWS Glue, Talend, Apache Zookeeper, IBM Cloud Pak, Apache Atlas, Collibra Data Governance, Stonebranch |

|

Data Visualization |

Tableau, Looker, Microsoft Power BI, Grafana, D3.js, Google Charts, Qlik |

Wrapping it Up

With the advent of technologies like big data analytics, processes in the oil and gas industry are undergoing massive changes. This transformation is streamlining operations, boosting productivity, and reducing costs across the organization. Therefore, investing in a robust big data analytics solution can empower the business transformation and how your organization handles and analyzes data.

At Decipher Zone, we have a specialized team of professionals who are well-versed in developing big data analytics software solutions for the oil and gas industry that meet their business objectives and overcome challenges.

Are you ready to elevate your business with advanced big data analytics software? Our team of experts is here to support you create robust, data-driven solutions that enhance operational efficiency and deliver precise analytical insights—all tailored to fit your budget. Reach out to us today and turn your vision into reality!

Questions, You Might Have

-

How is big data analytics shaping the oil and gas industry?

Using big data analytics enables oil and gas businesses to gain actionable insights and future predictions by analyzing data from diverse sources. These insights then make it possible to streamline processes, enhance decision-making, reduce operational costs, improve sustainability, minimize risks, better exploration, and so much more.

-

What is the cost of developing big data analytics software for oil and gas companies?

Developing big data analytics software for oil and gas companies can cost anywhere from $100,000 to $300,000. The cost variation in the development of these software depends on the features, complexity, data integration, real-time processing requirements, scalability, tools, level of predictive analytics involved, and AI/ML intricacies.

-

Why oil and gas companies must act on analytics?

Insights from analytics serve as the backbone of the oil and gas industry. By utilizing insights from big data analytics software, companies can monitor compliance with industry regulations, enhance environmental sustainability, identify safety risks, prevent accidents, improve drilling accuracy, and manage production accounting.

-

What are the major big data analytics trends that will improve operations in the oil and gas industry?

Edge computing, cybersecurity analytics, predictive maintenance, real-time data processing, blockchain, artificial intelligence, machine learning, and augmented reality are the major trends in the big data analytics solutions that will boost the oil and gas sector operations tremendously.